Cost-Effective

Access our easy and rapid services anywhere. A single document completes your application

Access our easy and rapid services anywhere. A single document completes your application

Count on us as your innovative direct lender. We guarantee data privacy and offer help when you need it most

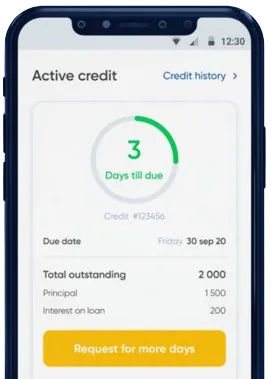

Straightforward solutions in just minutes from home. Money is transferred instantly; extend loans as needed

Apply through the app by completing the necessary form.

Anticipate our decision, made swiftly in 15 minutes.

Have the money transferred to you, usually within one minute.

Apply through the app by completing the necessary form.

Download loan app

When it comes to meeting urgent financial needs, payday loans are a popular choice for many individuals in Nigeria. These short-term loans provide a quick and convenient way to access cash when financial emergencies arise.

Payday loans are small, unsecured loans that are typically repaid on the borrower's next payday. These loans are designed to provide a quick solution to financial emergencies, such as unexpected medical bills, car repairs, or other urgent expenses.

One of the main benefits of payday loans is the quick and easy application process. Most lenders in Nigeria offer online applications, which can be completed in a matter of minutes. This means borrowers can access funds quickly, often within 24 hours.

Unlike traditional bank loans, payday loans do not require any collateral. This makes them accessible to a wider range of borrowers, including those with limited or no assets.

There are several benefits to utilizing payday loans in Nigeria:

Fast Approval: Payday loans offer quick approval, allowing borrowers to access funds when they need them most.

Flexible Repayment Options: Many lenders offer flexible repayment options, making it easier for borrowers to manage their finances.

Convenience: With online applications and quick disbursal of funds, payday loans offer a convenient solution to financial emergencies.

Payday loans can be useful in a variety of situations, including:

By providing quick access to cash, payday loans can help individuals meet their financial needs without delay.

In conclusion, payday loans offer a practical and efficient way to access funds quickly in Nigeria. With their fast approval process, flexible repayment options, and convenience, payday loans can be a valuable tool for individuals facing urgent financial needs. However, it is important to borrow responsibly and only take out a payday loan if you are confident in your ability to repay it on time.

A payday loan is a short-term, high-cost loan that is typically due on the borrower's next payday.

In Nigeria, payday loans are usually offered by financial institutions or online lenders. Borrowers can apply for a loan and receive funds quickly, with the expectation that they will repay the loan in full, plus interest, on their next payday.

To be eligible for a payday loan in Nigeria, borrowers typically need to have a regular source of income, be over 18 years old, and have a valid bank account.

Payday loans can provide quick access to cash for emergency expenses or unexpected bills. They are also relatively easy to qualify for, even for borrowers with poor credit.

Payday loans often come with high interest rates and fees, making them a costly borrowing option. Borrowers can also get caught in a cycle of debt if they are unable to repay the loan on time.

Yes, payday loans are regulated by the Central Bank of Nigeria and other financial regulatory bodies to protect borrowers from predatory lending practices.